Where an employee is provided with a company car by their employer, a value, called the cash equivalent, is put on the benefit, and the employee is taxed on it via payroll.

Many employees got an unwelcome shock when they received their first payslip of 2023, as the tax on their company vehicles had increased significantly.

As part of measures to assist families dealing with the cost of living challenges, the Government yesterday announced a temporary relief on how the benefit of having a company car is calculated. This relief is included in Finance Bill 2023, which will be published in the coming days.

This change will see some welcome, albeit temporary, reductions in the tax employees pay on their company cars.

Q: How do I calculate the Cash Equivalent of my Company Car?

A: You need to know the original market value of the car i.e. the list price of the car on the date of first registration. This applies even if your employer bought the car second-hand or is leasing it. If your car is in vehicle CO2 categories A – D, you can now reduce this value by €10,000, thanks to the Finance Bill 2023 changes.

You also need to know the annual business mileage you drive and from 2023 onwards, you need to know the vehicle’s CO2 emissions. These determine the cash equivalent percentage for your car.

The annual Cash Equivalent of your car = Original Market value – €10,000 (if your car is in categories A – D) x Cash Equivalent Percentage.

Q: What qualifies as Business Mileage?

A: Business mileage means the total number of kilometres you are necessarily obliged to travel in the vehicle in the performance of your employment duties. Travel to and from work is generally regarded as private travel rather than business travel.

Q: What vehicle CO2 category applies to my car?

| Vehicle Category |

CO2 Emissions (CO2 g/km) |

| A |

0g/km up to and including 59g/km |

| B |

More than 59g/km up to and including 99g/km |

| C |

More than 99g/km up to and including 139g/km |

| D |

More than 139g/km up to and including 179g/km |

| E |

More than 179g/km |

Q: What cash equivalent percentage is applicable to me?

A: The cash equivalent percentage depends on your Vehicle C02 Category and the amount of Business mileage you have during the year. This table has also been updated by Finance Bill 2023 to reduce the upper limit in the highest mileage band to 48,001 (previously 52,001):

| Lower Limit |

Upper Limit |

A |

B |

C |

D |

E |

| Km |

Km |

% |

% |

% |

% |

% |

| — |

26,000 |

22.50 |

26.25 |

30 |

33.75 |

37.5 |

| 26,001 |

39,000 |

18 |

21 |

24 |

27 |

30 |

| 39,001 |

48,000 |

13.50 |

15.75 |

18 |

20.25 |

22.50 |

| 48,001 |

— |

9 |

10.50 |

12 |

13.5 |

15 |

Q: What has changed to the BIK rules in 2023?

A: Previously, the benefit of having a company car was calculated by taking the annual cash equivalent of the company car at 30% of its original market value. Where business mileage exceeded 24,000km, the cash equivalent was reduced by a percentage which ranged from 6% to 24% based on the number of business kilometres travelled.

From 2023 onwards, the cash equivalent of a company car depends on both the business mileage and the vehicle’s CO2 emissions.

Example:

Pre 2023:

An employee drives a Category B car (CO2 Emissions More than 59g/km up to and including 99g/km) with an original market value of €35,000. The employee drove 45,000 business km in the year. The annual benefit on which the employee was taxed was €4,200 (€35,000 x 12%).

If paid monthly, this was additional taxable income of €350 per month (€4,200 / 12 months), on which the employee was taxed.

2023 Onwards:

In 2023 the benefit of having the same car and doing the same mileage is €3,938 (€35,000- €10,000 x 15.75%).

If paid monthly, this is now additional taxable income of €328 per month (€3,938 / 12 months), on which the employee is taxed.

Q: What reliefs if any can I avail of?

A: If you travel less than 26,000 business km in a year, the cash equivalent of your car may be reduced by 20% if you satisfy all the following conditions:

- You work an average of 20 hours per week,

- You have business mileage of at least 8,000km per annum,

- You spend at least 70% of your working time away from your employer’s premises, and

- You retain a log book with details of your business mileage and work purposes.

Example:

Your company car has an original market value of €35,000 and a CO2 emissions of 95g/km. All running costs are paid by your employer. You work full time and travel 15,000 km per year for work related purposes. You spend more than 70% of working time away from your employers premises and keep a log book.

With Relief Without Relief

(€35,000 – €10,000) x 26.25% €6,563 (€35,000 – €10,000) x 26.25% = €6,563

Less reduction of 20% (€1,313)

Annual Benefit €5,250

Q: What has changed in relation to my van?

A: From 1st of January 2023, the percentage to calculate the cash equivalent a company van has increased from 5% to 8%. You can reduce the original market value of your van by €10,000 thanks to the Finance Bill 2023 changes. The business mileage driven or the CO2 emissions are not relevant for vans.

Example:

Van with an original market value of €35,000.

Pre 2023: The annual cash equivalent on which you were taxed = €35,000 x 5% = €1,750 (€146 per month if paid monthly)

2023 onwards: The annual cash equivalent on which you are taxed = €35,000 – €10,000 x 8% = €2,000 (€167 per month if paid monthly)

Q: I drive an electric vehicle. Is anything different for me?

A: In 2023 fully electric cars also benefit from the Finance Bill 2023 temporary changes. Now cars with an original market value of €45,000 or less are not taxed. If your fully electric car has an original market value of greater than €45,000, you will be taxed based on the excess value as shown in the example below:

An employee drives a Category A fully electric car (CO2 Emissions of 0g/km up to and including 59g/km) with an original market value of €80,000. The employee drives 40,000 business km in the year.

Taxable original market value = €80,000 – €45,000 = €35,000

Annual Cash Equivalent of use of Electric car = €35,000 x 13.5% = €4,725.

Q: Will the Finance Bill 2023 temporary changes be backdated?

A: Yes, these changes will be back dated to the 1st of January 2023.

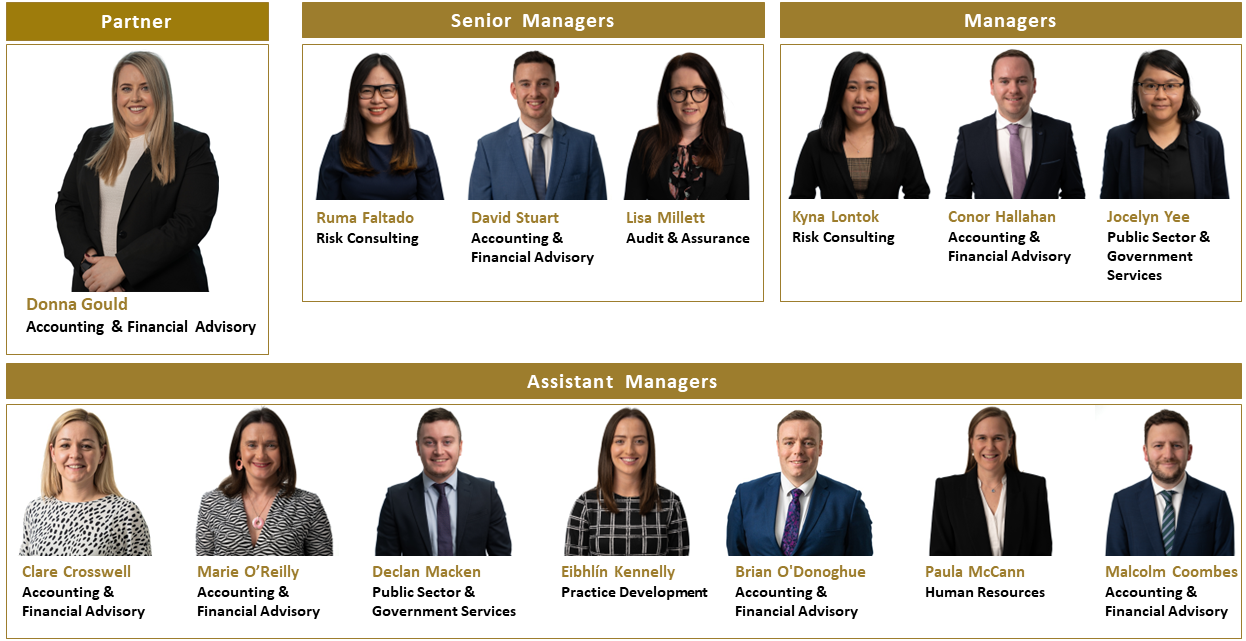

If you have any further questions about these new BIK rules, please contact us.